How to open a business in the United States as a foreigner

- Inicio

- Business Consulting

- How to open a business in the United States as a foreigner

If your business plan includes having your own company in the USA, now is the time! We support you in all the activities related to the registration, registration and tax procedures of your own CORP or LLC in the USA.

The process is fast and we support you in everything that follows:

- 1. Registration of the trade name with the county and/or city (municipality)

- 2. Registration and application for state identification number for sales tax collection and payment authorization (and withholding tax in states where applicable)

- 3. Registration with the Department of Labor for payment of state payroll taxes

- 4. Application for Federal Employer Identification Number (EIN with the IRS)

- 5. Registration with the Secretary of State for your Corporation (Corporation or LLC)

- 6. Accounting and tax training so that you have the necessary knowledge to carry out the activities of your business and know the most important tax responsibilities.

- 7. Advice on all the necessary procedures for the opening and/or initiation of your business, including paperwork, licenses, permits, etc.

- 8. Development of your business plan, from name selection to financial plan.

The process is very quick and easy, you only need the following:

- 1. Company name

- 2. Fiscal address

- 3. Partners and % shareholding (at least one partner is required)

- 4. Names of officers who will make formal decisions

Share:

Categories

More Posts

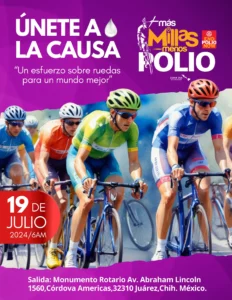

12 Days on Wheels to Beat Polio

“With your help, we can eradicate polio and save lives. 💉👶 Support our vaccination and healthcare programs to protect the

¿Why is it so important to have a virtual address to open a company in the USA?

If you are setting up a new company in the USA you will need a physical address, you will need